How To Register A Business In Ontario – Step By Step Guide (2023)

So, you’ve finally decided to start your own business. You’re a Canadian living in Ontario & you’ve come up with a bulletproof business plan. The only thing stopping you from those five-figure months is yourself and a lot of time. Things are getting real!

There’s just one thing – you don’t have any sales coming in just yet, and if you want to reap the tax benefits of running your own business, you’ll need to register your business name with the Government of Ontario.

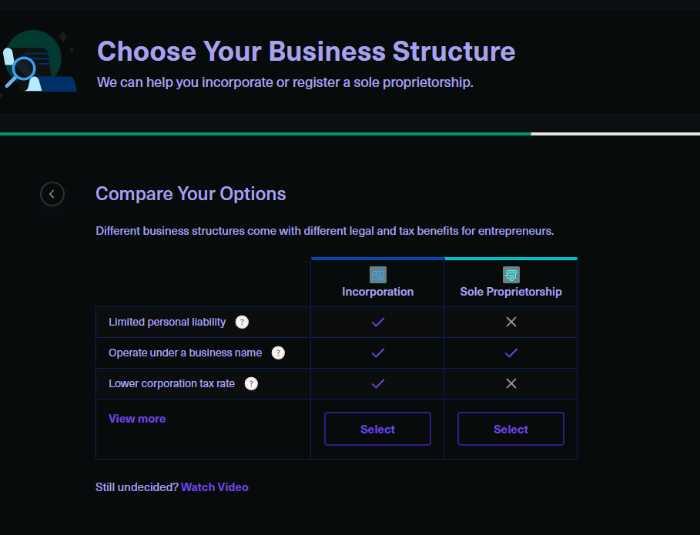

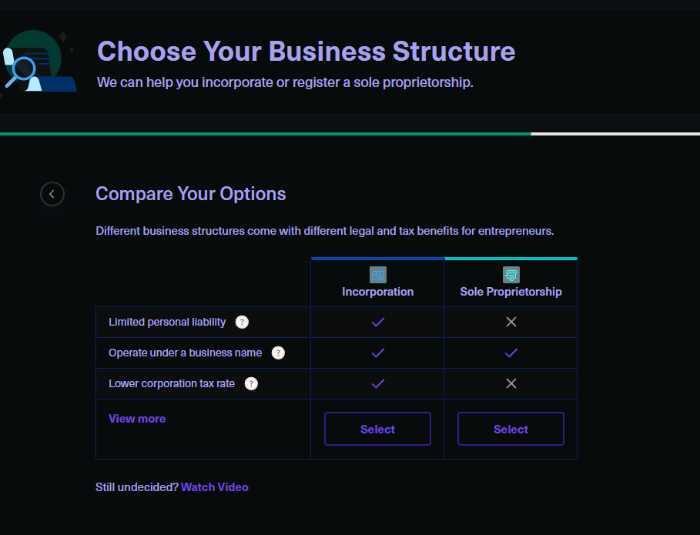

You’ll also want to decide if you should register as a sole proprietorship or corporation business structure. You can also register as a partnership, but it is the least common legal business structure so we won’t be covering partnership registration in this post.

You may also elect to use Ownr.co to complete your sole proprietorship or corporation business registration without hassle.

In this beginner’s guide, we’ll cover everything you need to know about business registration in Ontario, Canada, including:

- How to decide your business structure: Sole Proprietorship vs. a Corporation

- How to register a Sole Proprietorship in Ontario.

- How to register a Sole Proprietorship in Ontario using Ownr.co.

- How to register a Corporation in Ontario.

- How to register a Corporation in Ontario using Ownr.co.

Before proceeding any further with any business registration, I strongly encourage you to seek independent legal advice and not rely only on this article. This is not professional legal advice, only general information. With that out of the way, let’s get started.

Registering your Ontario Business (Step-by-step Guide)

1. How to decide your business structure: Sole Proprietorship vs. Corporation

The two most common business structures in Canada are sole proprietorships and corporations. To determine the right fit for your business, let’s dive deeper into each one.

Sole Proprietorship

A sole proprietorship is ideal for small businesses and entrepreneurs who want exclusive business control, are just starting up, and are comfortable with taking on unlimited liability.

In a sole proprietorship, there is no legal distinction between the business and the owner, which means that the owner is personally liable for all debts and obligations of the business. If a third party sues you, your personal assets (home, car, etc.) could be at risk. You and the business are one entity.

Corporation

A corporation is a legal entity that is separate and distinct from its owners. This means that the shareholders of a corporation are not liable for the debts and obligations of the corporation.

In a corporation, you, as the business owner – your personal assets are separate from the corporation. This means your personal assets are not liable if your company is sued. You and the corporation are two separate entities.

Because of this, it is more costly to set up and maintain a corporation than a sole proprietorship.

2. How To Register a Sole Proprietorship in Ontario

If you’ve decided to register a sole proprietorship, you’ll first need to choose a business name.

Choosing a Business Name – Sole Proprietorship

This is your time to get creative! Choose a business name that reflects your brand & business.

A sole proprietorship name can’t imply incorporation or other business structures. For example, it can’t include the words “Incorporated,” “Limited,” “Partnership,” or “Not-for-Profit.”

Check Your Business Name Availability

When starting a new business, it’s essential to check the internet to ensure no one is already using your business name, trademark, or logo. Ensuring you’ve chosen a unique business name and brand will help you avoid legal trouble down the line. The last thing you want is to finally scale your business to 7 figures, only to completely rebrand because the business name you’ve chosen is already copyrighted.

The easiest way to check this in Ontario is by using NUANS, the Canadian business name and trademark database. Each report you run in NUANS costs $13.80.

You should also quickly run your company name in Google, YouTube & Amazon searches and make sure there aren’t any businesses already using your name.

Registering Your Business Name Online

The easiest way to register your business name is online, on the Government of Ontario’s website.

You’ll need to provide the following:

- Business name

- Mailing address

- Business address (address of the principal place of business)

- Brief description of the business activity (NACIS Code)

The online application fee is $60, and your master business license and business number will be emailed within two business days.

Your business license needs to be renewed every five years before expiration. The renewal fee is also $60.

3. How to Register a Sole Proprietorship in Ontario using Ownr

If you want to speed up the manual filing of your sole proprietorship, I recommend using Ownr.

Ownr can only be used in Ontario, British Columbia & Alberta for business registration. It’s quick & easy, and at the time of writing, you’ll also get an $89 refund by registering for an RBC Digital Choice Business Bank Account.

Here’s how to register your sole proprietorship with Ownr:

1. Gather your business information

- Your business name

- Your contact information (address, phone number, email)

- The type of business you’ll be operating

2. Complete the Ownr registration process as shown in the images below.

Select “New Business”

Select “Ontario.”

Select “Sole Proprietorship.”

Enter your business name:

Sign up for an account:

Enter your Personal Information:

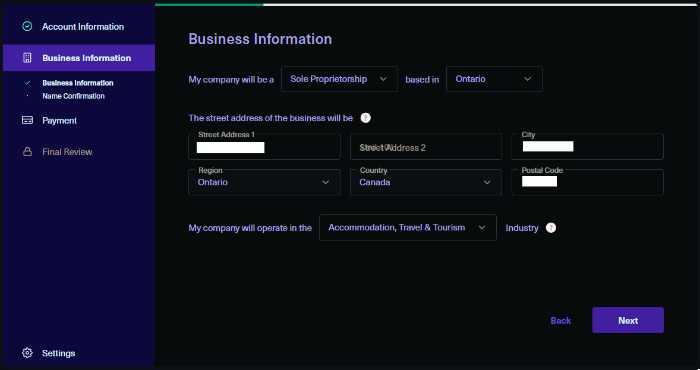

Enter your Business Information.

This is where your “main office” is located. If you are just starting out, it can be the same address as your home address.

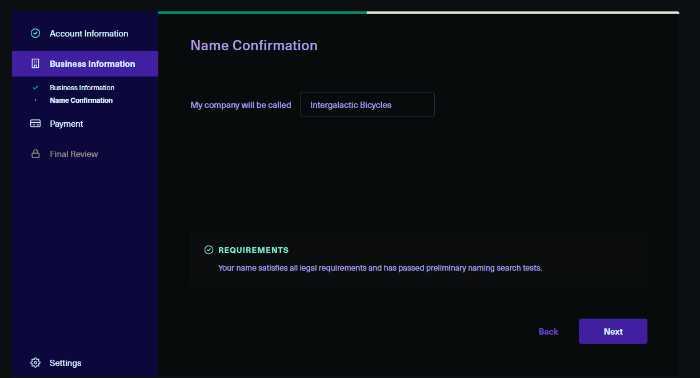

Confirm your Business Name:

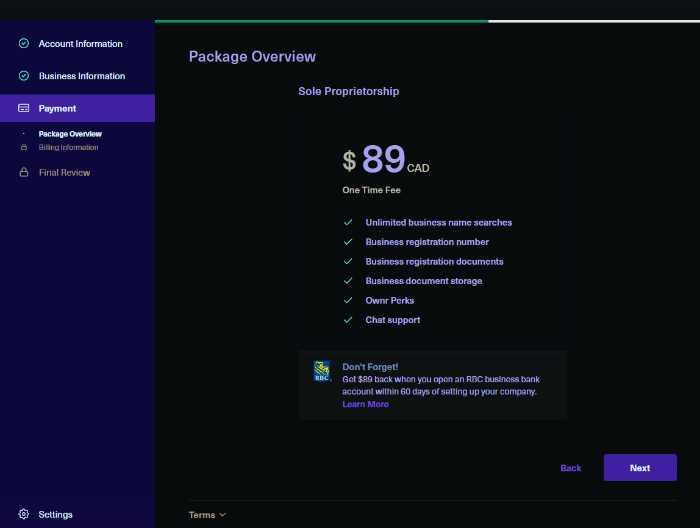

Confirm the fee and enter your payment information on the next page.

The $89 fee includes the $60 Ontario Business Registration Fee.

Ownr has an excellent support team that can be reached over chatbot and email if you have questions about this process.

4. How To Register a Corporation in Ontario

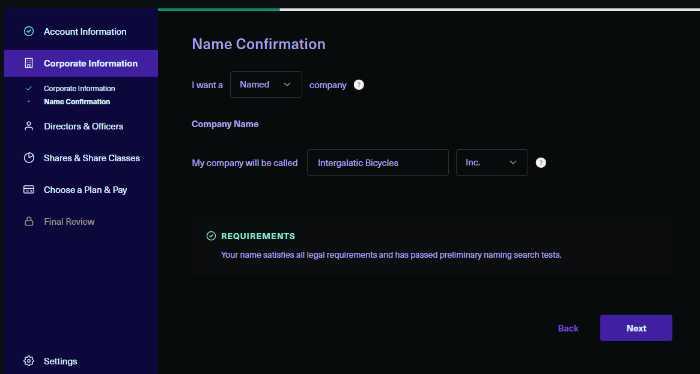

Choosing a business name – Corporation

The rules for naming a corporation differ from those for naming a sole proprietorship or partnership. A corporation can have any legal name, as long as it is not the same as another business name already registered in Ontario.

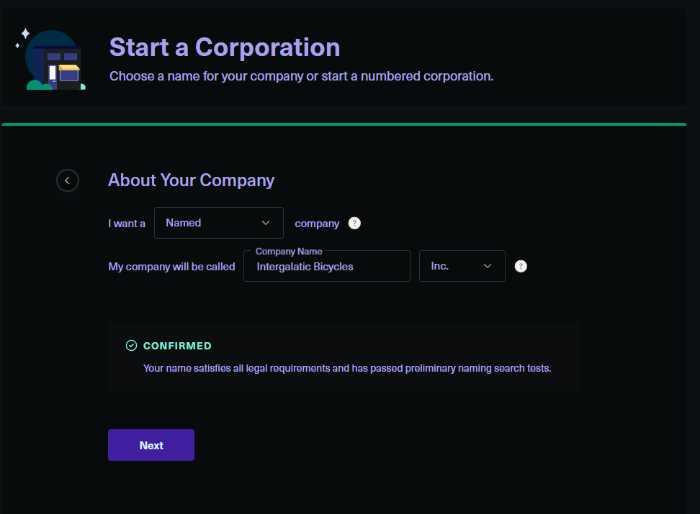

You can have a “named” or “numbered” corporation.

For a “named” corporation, the name must end with “Limited” or “Incorporated.” It cannot contain certain restricted words or expressions, such as “bank,” “insurance,” “university,” or “municipality.” For example, Acme Blogging Inc.

The Ontario government assigns a number instead of a name for a numbered corporation. The number must appear in the corporation’s legal name, followed by “Limited” or “Incorporated.” A numbered company example is 8763232182 Ontario Inc.

It is mandatory to use NUANS before registering the name of your corporation, and the NUANS must have been filed within the last 90 days before submitting your application.

Filing Articles of Incorporation

The first step in incorporating a corporation is to file articles of incorporation with the Ministry of Government and Consumer Services.

You must include the following information for Form 1:

- The “named” or “numbered” business name

- The address of the corporation’s initial registered office in Ontario

- The names, addresses, and signatures of the incorporators and directors

- The classes or kinds of shares that the corporation is authorized to issue

- Rights & conditions that may be attached to each class of shares

- Restrictions on any transfer or ownership of shares

Creating your Cover Letter or Other Documentation

When you submit your articles of incorporation, you must also include a cover letter or other documentation. The cover letter must include the following information:

- Your name, address & telephone number

A person listed as a director (not an incorporator) must also complete Form 2, “Consent to Act as a First Director.”

We can’t forget about the cost. Online filing of the Articles of Incorporation costs $300, plus any fees charged by the service provider. More information can be found here on the Ontario Government’s website.

If you choose to mail or file in person, the fee is $360.

The articles of incorporation, NUANS report, cover letter, $360 cheque payable to the Minister of Finance, and any other required documentation can be sent by regular mail or in-person to:

Central Production and Verification Services Branch

393 University Avenue, Suite 200

Toronto, Ontario

M5G 2M2

5. How To Register a Corporation in Ontario Using Ownr

If you want to register a corporation in Ontario using Ownr, there are just a few simple steps. It’s very similar to the sole proprietorship process.

1. Gather your business information, and go to Ownr’s registration site.

2. Complete the step-by-step online process shown earlier in this article, except you will want to select “Incorporation” instead of Sole Proprietorship.

When prompted, fill out your “named” or “numbered” business name.

Enter your business address, and choose your fiscal year-end date.

Confirm your business name.

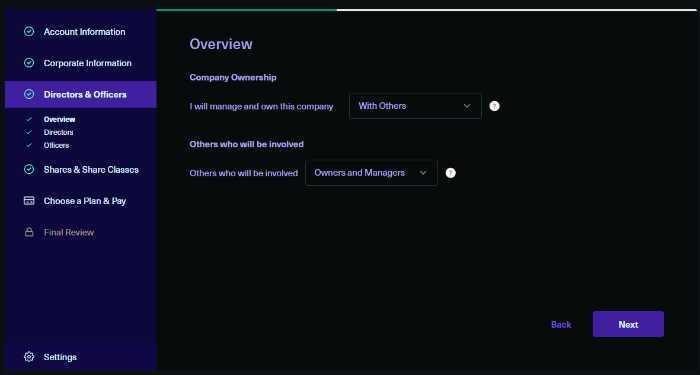

Choose whether you will run the company yourself or with others.

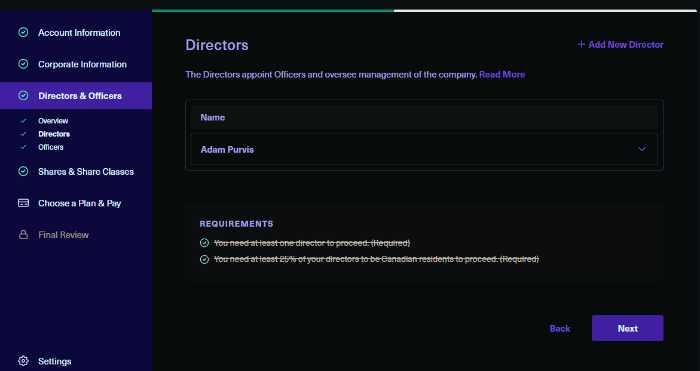

Choose and add any Directors or Officers of the Company.

Enter shareholders & shareholder percentage.

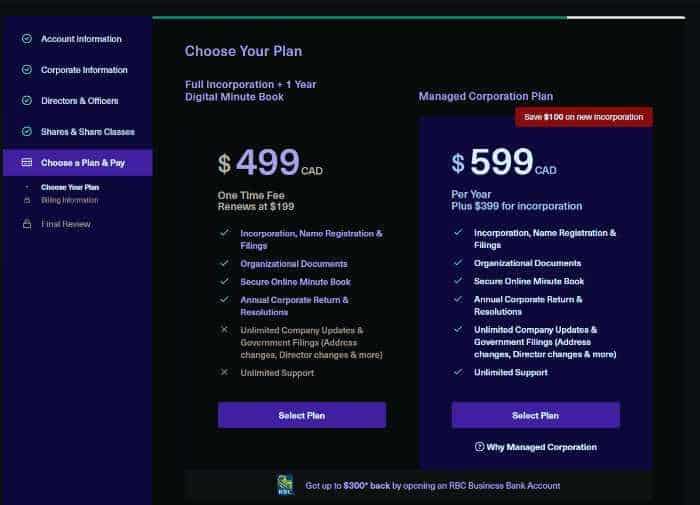

Choose your plan and pay.

As you can see, Ownr significantly shortens the process.

Ownr also organizes and prepares your corporation documents, including:

- First Directors Resolution

- Director Consent

- Directors, Securities & Officers Register

- Shareholders Ledger

- Any bylaws

- Notice of Issuance

- And any other relevant documents.

Provincial incorporation in Ontario using Ownr costs $599 + HST. This includes the $300 government fee.

As of writing, you can also take advantage of $300 cashback from RBC if you open an RBC Business Bank Account within 60 days of incorporating with Ownr.

Frequently Asked Questions (FAQs)

1. What are the benefits of incorporating my business in Ontario?

There are many benefits to incorporating your business in Ontario. Incorporation can help to protect your personal assets from business debts and liabilities. Incorporation can also make raising capital, attracting investors, and establishing business credit easier. In addition, corporations often have more flexible governance structures than other business types, which can give you greater control over your business.

2. What are the requirements for incorporating my business in Ontario?

To incorporate your business in Ontario, you must first choose a legal name for your corporation. The name must be unique and not already in use by another business. You will also need to file articles of incorporation with the Ministry of Government and Consumer Services, which must include specific information about your business. In addition, you will need to obtain a NUANS report and complete a cover letter or other documentation.

3. How do I choose a legal name for my corporation?

To choose a legal name for your corporation, you can use a naming service such as Ownr. Once you have selected a word, you will need to check whether it is available or not already used by another business. You can do this by searching the Ontario Business Names Registry or contacting the Ministry of Government and Consumer Services.

4. How do I file articles of incorporation?

You can file articles of incorporation online or in person with the Ministry of Government and Consumer Services. When you file, you must include specific information about your business, such as the corporation’s legal name, address, and contact information. You will also need to provide a NUANS report and pay a filing fee.

5. How do I obtain a NUANS report?

You can obtain a NUANS report by visiting the NUANS website by clicking here. The cost is $13.80 for each report.

6. How long does it take to incorporate my business in Ontario?

The incorporation process can take anywhere from a few days to a few weeks, depending on the complexity of your business and the availability of the desired name.

7. Do I need a lawyer to incorporate my business in Ontario?

You are not required to hire a lawyer to incorporate your business in Ontario. However, you may find it helpful to consult with a lawyer or other professional service provider if you have complex legal needs or are unsure about the incorporation process.

8. What are the ongoing requirements for corporations in Ontario?

Once your corporation is incorporated in Ontario, you must comply with certain ongoing requirements. For instance, you will need to hold annual shareholder meetings, keep corporate records, and file annual reports with the Ministry of Government and Consumer Services. You will also be required to pay taxes, such as income tax and GST/HST.

9. Can I change my business structure after I incorporate it?

Yes, you can change your business structure after you incorporate it. However, you will need to dissolve your corporation and re-incorporate under a different business type.